wyoming tax rate for corporations

The states average effective property tax rate is just 057 10th-lowest in the US. A 7 percent corporate income tax on these operations still means that the state has a very low tax burden but if it makes some of these chains locations outside of Cheyenne Casper and Laramie less viable that could have a profound impact on peoples daily lives.

How To Register A Foreign Non Profit Corporation In Wyoming

With corporate tax treatment the LLC must file tax return 1120 and pay taxes at the 2018 corporate tax rate of 21 percent.

. The state has a 5 tax but the average local tax is 42 making a total of 542. Wyoming corporations and Wyoming LLCs are required to pay a fee each year when filing their annual report. The corporate tax rate applies to your businesss taxable income which is your revenue minus expenses eg cost of goods sold.

This fee is 60 or two-tenths of one million on the dollar 0002 of all in-state assets whichever is greater. LLC profits are not subject to self-employment taxes but any profits distributed to owners as dividends are taxable at the appropriate capital gainsdividend tax rates. The current corporate tax rate federal is 21 thanks to the Tax Cuts and Jobs Act of 2017.

However Wyoming does have a property tax. No tax return Joint. Federal Corporate Tax Rate Example.

D Illinois rate includes two separate corporate income. B Floridas corporate income tax rate willl return to 55 for tax years beginning on or after Jan. Are there personal exemptions.

9 rows 10 -Wyoming Corporate Income Tax Brackets. Property Tax is assessed at 115 for industrial property and assessed at 95 for. We include everything you need for the LLC.

An S-Corp can be taxed more or less but avoids double taxation. If the holding company owns property in Wyoming the company should expect to pay property taxes at the following rates. C Georgias corporate income tax rate will revert to 6 on January 1 2026.

Individual municipalities may add a little more to this sales and. There are a total of 104 local tax jurisdictions across the state collecting an average local tax of 1436. But thats not all that Wyoming has going for it.

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. What forms do you file for your Wyoming taxes. Wyoming charges a sales and use tax of 4 for which you will need a license to collect if you sell physical goods andor provide certain types of services.

See the publications section for more information. In addition Local and optional taxes can be assessed if approved by a vote of the citizens. Average Sales Tax With Local.

Since there is no income tax there is no form to file. Wyoming also does not have a corporate income tax. This will cost you 325 for a corporation or an LLC.

What is the average Wyoming sales tax rate. Effective July 1 2021 there will be an increase from 12 to 20 in the collection fee on SalesUse Tax Accounts that have been referred or will be referred to an external collection agency. Wyomings Sales and Use Tax.

An S-Corp is not taxed at the same rate as a C-Corporation which is 21 at the time of this writing. No tax return Dependents. Each year youll owe 50 to the State of Wyoming to keep your Wyoming company in good standing and 125 a year to us as your Wyoming Registered Agent.

2018 Long-Term Capital Gains and Dividends Tax Rate. LLCs under a C-Corporation election that accumulate and do not distribute after tax profits are subject to an accumulated earnings tax. Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your earnings.

Are there standard deductions. This is typically at a rate of 153 percent. The tax rate is 20 percent the rate is reduced to 15 percent for certain specific items Accumulated Earnings Tax.

We recommend you form a Wyoming LLC or incorporate in Wyoming. These options should be discussed with a CPA. Tax Bracket gross taxable income Tax Rate.

Wyoming has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 2. The maximum tax rate was 35. Likewise the states average sales tax rate incorporating state and local rates is only 539 seventh-lowest nationally.

State wide sales tax is 4. Wyomings tax system ranks 1st overall on our 2022 State Business Tax Climate Index. Prior to the Tax Cuts and Jobs Act there were taxable income brackets.

Even Wyomings gas tax is lower than average at 23 cents per gallon. Each states tax code is a multifaceted system with many moving parts and Wyoming is.

55 Corporations Paid 0 In Federal Taxes On 2020 Profits Itep

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Capital Gains Tax Rates By State Nas Investment Solutions

Delaware Or Wyoming Usformation

Why Form A Corporation In Wyoming Registered Agents Of Wyoming Llc

55 Corporations Paid 0 In Federal Taxes On 2020 Profits Itep

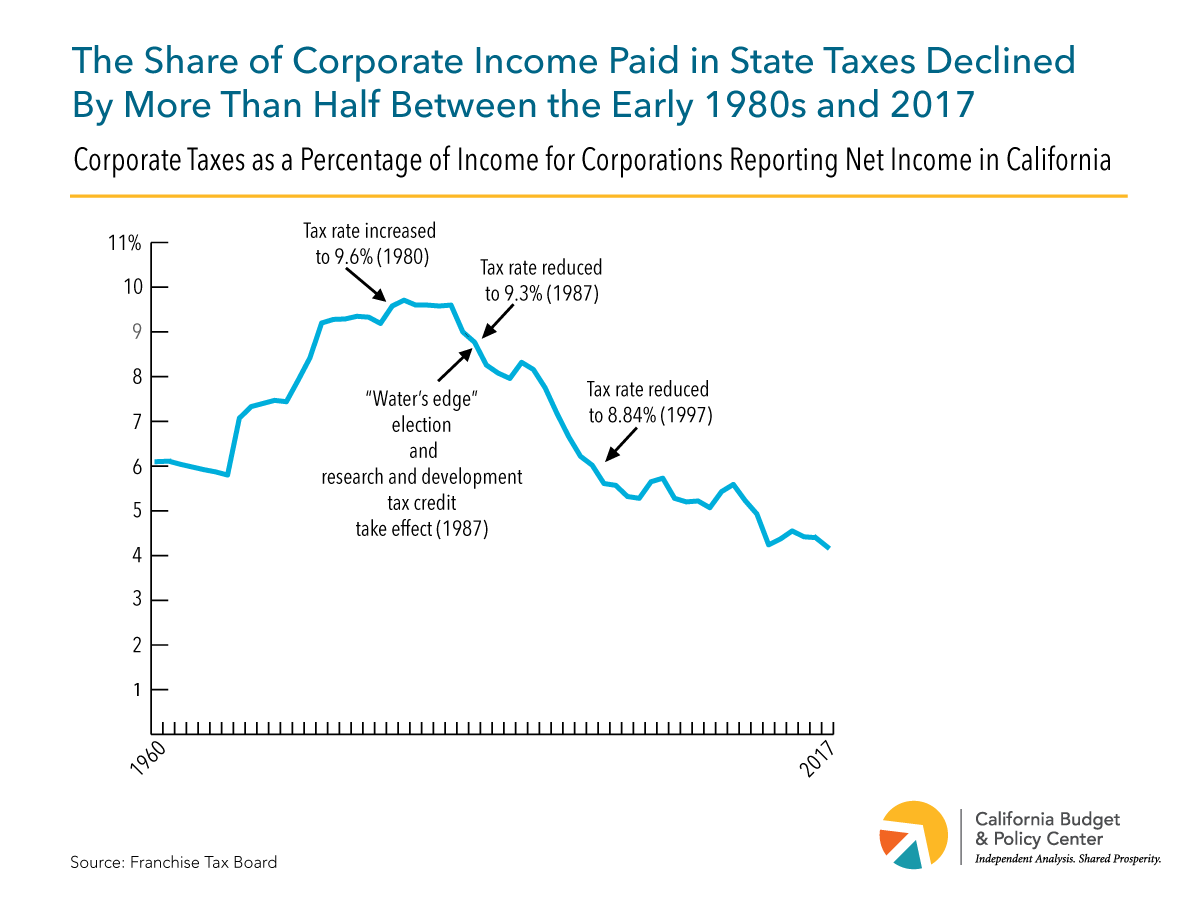

California Sunshine By Pat Garofalo Boondoggle

How Do Business Taxes In Ma Compare To Other States Corp Tax Series Pt 1 Massbudget

Top Marginal Corporate Income Tax Rate Rich States Poor States

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Increased Wind Tax Makes Its Way Back Into Discussion Wyoming Public Media

Llc Tax Calculator Definitive Small Business Tax Estimator

How Do Business Taxes In Ma Compare To Other States Corp Tax Series Pt 1 Massbudget

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Here Are Some Truths About Corporate Tax Avoidance Itep

Share Of State Taxes Contributed By Corporate Income Tax Download Table

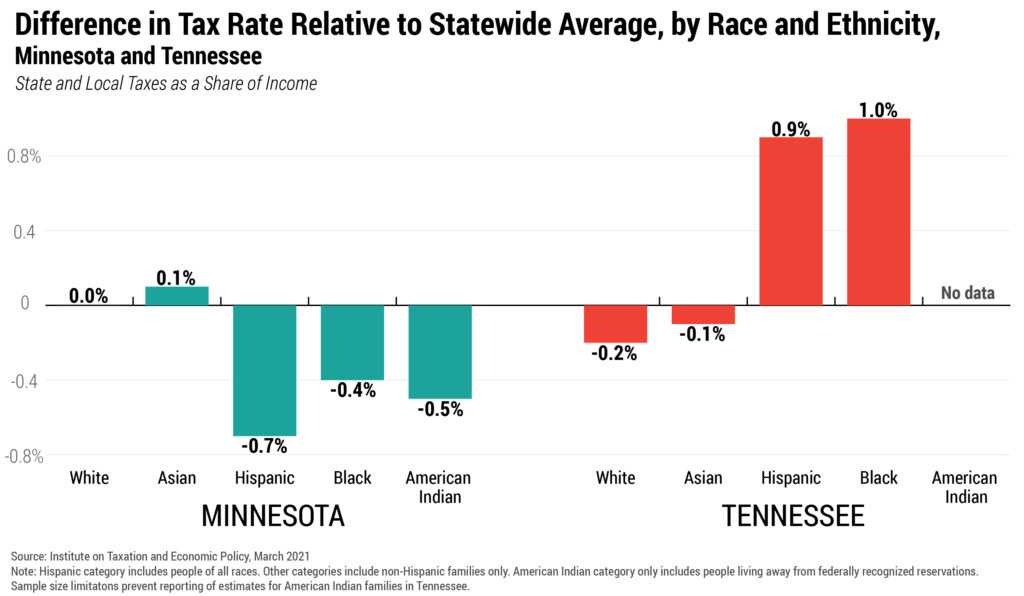

Taxes And Racial Equity An Overview Of State And Local Policy Impacts Itep